Nearly 1 in 7 Homes Across US Are Uninsured

Houses are often Americans’ biggest investment, but many don’t have the proper safety nets to protect them. In fact, 11.3 million U.S. owner-occupied homes are uninsured, according to the latest LendingTree study, leaving these homeowners vulnerable to disasters.

Here’s a look at where the rate of uninsured homes is highest, and our top tips on finding the best home insurance rates.

Key findings

- Nearly 1 in 7 homes across the U.S. are uninsured. 11.3 million of 82.9 million owner-occupied homes, or 13.6%, are uninsured.

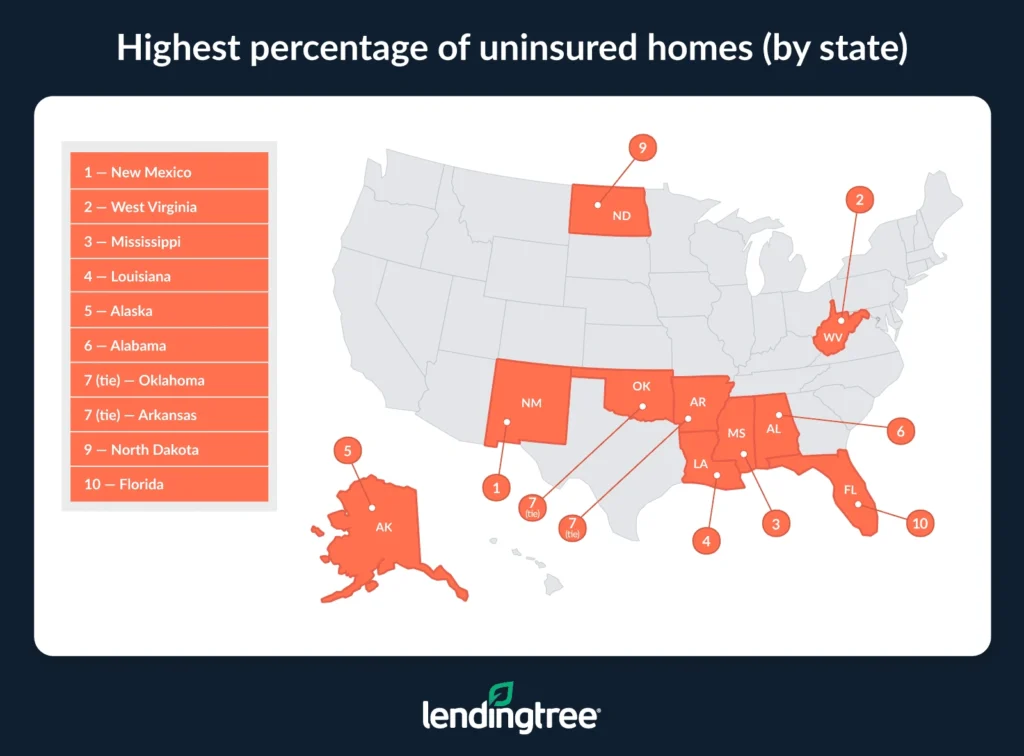

- New Mexico has the highest rate of uninsured homes. 23.3% of homes in the state don’t have insurance coverage, ahead of West Virginia (23.0%) and Mississippi (22.9%).

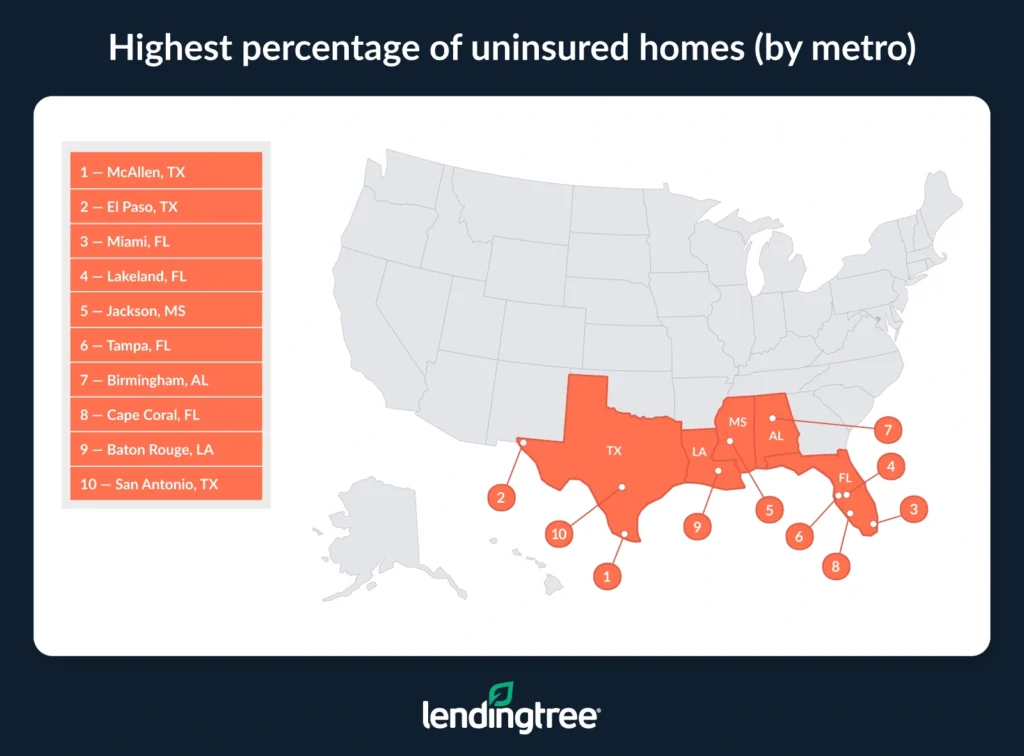

- Among the largest U.S. metros, McAllen, Texas, has the highest uninsured rate — by a massive margin. 43.3% of homes in the Texas metro don’t have home insurance, more than 20 percentage points higher than fellow Texas metro El Paso at 23.0%. Miami (21.0%) rounds out the top three.

- Florida’s Miami-Dade County has the highest rate of uninsured homes among the country’s most at-risk counties. Considering the 25 counties with the highest National Risk Index (NRI) scores, Miami-Dade County tops the list at 23.5%. Fellow Florida counties — Broward County (22.7%) and Lee County (17.9%) — follow.

LendingTree analysts classified uninsured homes as owner-occupied homes with annual home insurance costs of less than $100. The number of owner-occupied homes that paid less than $100 in annual home insurance costs in 2023 was divided by the total number of owner-occupied homes to calculate the percentage of uninsured homes. This was done nationally and by state and metro.

Analysts also utilized Federal Emergency Management Agency (FEMA) data to calculate uninsured rates among the 25 most at-risk counties. These are the counties with the highest risk from 18 FEMA-identified hazards: avalanches, coastal flooding, cold waves, droughts, earthquakes, hail, heat waves, hurricanes, ice storms, landslides, lightning, riverine flooding, strong winds, tornadoes, tsunamis, volcanic activity, wildfires and winter weather.

13.6% of U.S. homes are uninsured

Of the 82.9 million owner-occupied homes in the U.S., 11.3 million are uninsured. That’s 13.6%, or about 1 in 7.

LendingTree home insurance expert and licensed insurance agent Rob Bhatt says this is troubling.

“For most people, your home is your most important investment,” he says. “It’s important to protect that investment with insurance. Insurance has become more expensive and harder to get in recent years. This is putting people just one disaster away from losing the physical and financial security their home provides.”

23.3% of New Mexico homes are uninsured

By state, New Mexico has the highest rate of uninsured homes, with 23.3% not covered. West Virginia and Mississippi follow at 23.0% and 22.9%, respectively.

According to Bhatt, homeowners in these states may overlook crucial risks. “Wind and hail damage is the most common homeowners insurance claim,” he says, “Of the top three states, this is especially true in Mississippi. Wind and hail damage is covered by standard homeowners insurance in most parts of the country. However, you have to buy windstorm coverage separately in some of Mississippi’s coastal areas.”

Additionally, house fires and flooding are risks homeowners could face anywhere in the country. “Standard home insurance doesn’t cover floods, including storm surges from hurricanes and tropical storms,” Bhatt says. “You have to purchase flood insurance separately to protect your home from this risk. Unfortunately, paying for both standard homeowners and flood insurance can be expensive.”

The District of Columbia has the lowest rate of uninsured homes (8.9%). New Hampshire (9.2%), Oregon (9.6%), Massachusetts (9.7%) and Utah (9.7%) are the only others below 10.0%.

Full rankings: States with the highest rate of uninsured homes

| Rank | State | Homes | Homes w/out insurance | % of homes w/out insurance |

|---|---|---|---|---|

| 1 | New Mexico | 572,064 | 133,340 | 23.3% |

| 2 | West Virginia | 536,082 | 123,319 | 23.0% |

| 3 | Mississippi | 786,289 | 180,284 | 22.9% |

| 4 | Louisiana | 1,200,407 | 252,970 | 21.1% |

| 5 | Alaska | 178,369 | 36,445 | 20.4% |

| 6 | Alabama | 1,377,062 | 263,372 | 19.1% |

| 7 | Oklahoma | 1,015,207 | 192,310 | 18.9% |

| 7 | Arkansas | 786,534 | 148,488 | 18.9% |

| 9 | North Dakota | 206,123 | 38,614 | 18.7% |

| 10 | Florida | 5,756,809 | 1,041,989 | 18.1% |

| 11 | Texas | 6,723,729 | 1,188,376 | 17.7% |

| 12 | Kentucky | 1,223,574 | 214,040 | 17.5% |

| 13 | South Carolina | 1,478,858 | 242,748 | 16.4% |

| 14 | South Dakota | 246,105 | 39,726 | 16.1% |

| 15 | Montana | 314,266 | 50,173 | 16.0% |

| 16 | Kansas | 776,311 | 119,711 | 15.4% |

| 17 | Wyoming | 171,299 | 25,903 | 15.1% |

| 17 | Michigan | 2,946,157 | 444,514 | 15.1% |

| 19 | Arizona | 1,873,231 | 273,000 | 14.6% |

| 20 | Nebraska | 523,603 | 74,547 | 14.2% |

| 20 | Indiana | 1,886,485 | 267,432 | 14.2% |

| 22 | Missouri | 1,688,072 | 236,034 | 14.0% |

| 23 | Tennessee | 1,855,793 | 253,630 | 13.7% |

| 24 | North Carolina | 2,778,672 | 366,625 | 13.2% |

| 25 | Iowa | 932,618 | 122,329 | 13.1% |

| 26 | Georgia | 2,619,529 | 335,993 | 12.8% |

| 26 | Wisconsin | 1,660,505 | 212,888 | 12.8% |

| 28 | Ohio | 3,235,568 | 404,249 | 12.5% |

| 29 | Maine | 436,029 | 54,057 | 12.4% |

| 30 | Nevada | 701,914 | 86,354 | 12.3% |

| 31 | Idaho | 502,140 | 59,565 | 11.9% |

| 32 | Minnesota | 1,652,534 | 192,237 | 11.6% |

| 33 | Delaware | 286,340 | 32,788 | 11.5% |

| 34 | Illinois | 3,343,034 | 372,689 | 11.1% |

| 34 | New York | 4,164,793 | 463,884 | 11.1% |

| 34 | Rhode Island | 276,344 | 30,645 | 11.1% |

| 34 | Pennsylvania | 3,629,624 | 401,967 | 11.1% |

| 38 | Virginia | 2,234,492 | 235,725 | 10.5% |

| 38 | Hawaii | 305,869 | 32,115 | 10.5% |

| 38 | Washington | 1,929,694 | 202,484 | 10.5% |

| 41 | Connecticut | 939,912 | 97,980 | 10.4% |

| 42 | New Jersey | 2,215,482 | 226,403 | 10.2% |

| 43 | California | 7,494,811 | 758,553 | 10.1% |

| 43 | Vermont | 196,162 | 19,726 | 10.1% |

| 43 | Maryland | 1,578,702 | 158,726 | 10.1% |

| 46 | Colorado | 1,542,215 | 154,064 | 10.0% |

| 47 | Utah | 773,345 | 75,316 | 9.7% |

| 47 | Massachusetts | 1,728,986 | 167,822 | 9.7% |

| 49 | Oregon | 1,078,343 | 103,557 | 9.6% |

| 50 | New Hampshire | 399,663 | 36,908 | 9.2% |

| 51 | District of Columbia | 132,288 | 11,763 | 8.9% |

McAllen, Texas, metro has highest rate of uninsured homes

Among the 100 largest U.S. metros, McAllen, Texas, ranks highest with 43.3% of its homes uninsured. That’s a whopping 20 percentage points higher than the second-ranking metro, El Paso, Texas, at 23.0%. Miami (21.0%) follows.

Conversely, just 7.7% of Portland, Ore., owner-occupied homes are uninsured. Washington, D.C., follows, at 8.6%. Allentown, Pa., and Oxnard, Calif., tie for third at 8.7%. In total, 22 of the 100 largest U.S. metros have uninsured rates under 10.0%.

Full rankings: Metros with the highest rate of uninsured homes

| Rank | Metro | Homes | Homes w/out insurance | % of homes w/out insurance |

|---|---|---|---|---|

| 1 | McAllen, TX | 178,475 | 77,344 | 43.3% |

| 2 | El Paso, TX | 189,323 | 43,600 | 23.0% |

| 3 | Miami, FL | 1,394,735 | 292,688 | 21.0% |

| 4 | Lakeland, FL | 193,698 | 39,139 | 20.2% |

| 5 | Jackson, MS | 159,535 | 31,363 | 19.7% |

| 6 | Tampa, FL | 881,420 | 162,924 | 18.5% |

| 7 | Birmingham, AL | 325,240 | 59,983 | 18.4% |

| 8 | Cape Coral, FL | 236,433 | 42,303 | 17.9% |

| 9 | Baton Rouge, LA | 225,509 | 39,633 | 17.6% |

| 10 | San Antonio, TX | 602,739 | 98,057 | 16.3% |

| 11 | Augusta, GA | 154,034 | 24,542 | 15.9% |

| 11 | Tucson, AZ | 279,304 | 44,390 | 15.9% |

| 11 | Palm Bay, FL | 193,755 | 30,751 | 15.9% |

| 11 | Tulsa, OK | 261,641 | 41,491 | 15.9% |

| 15 | Wichita, KS | 163,311 | 25,249 | 15.5% |

| 16 | North Port, FL | 282,729 | 43,450 | 15.4% |

| 16 | Houston, TX | 1,592,707 | 244,649 | 15.4% |

| 18 | Greenville, SC | 265,150 | 40,314 | 15.2% |

| 18 | Albuquerque, NM | 255,568 | 38,836 | 15.2% |

| 20 | Little Rock, AR | 195,060 | 29,459 | 15.1% |

| 20 | Columbia, SC | 231,413 | 34,919 | 15.1% |

| 22 | Toledo, OH | 161,000 | 24,114 | 15.0% |

| 22 | Detroit, MI | 1,245,226 | 186,503 | 15.0% |

| 24 | Chattanooga, TN | 155,387 | 22,192 | 14.3% |

| 25 | Deltona, FL | 213,832 | 30,450 | 14.2% |

| 25 | Oklahoma City, OK | 359,717 | 51,089 | 14.2% |

| 27 | Memphis, TN | 313,655 | 43,718 | 13.9% |

| 27 | New Orleans, LA | 239,444 | 33,246 | 13.9% |

| 29 | Grand Rapids, MI | 324,303 | 44,591 | 13.7% |

| 29 | Jacksonville, FL | 426,007 | 58,257 | 13.7% |

| 31 | Winston-Salem, NC | 188,742 | 25,658 | 13.6% |

| 32 | Orlando, FL | 623,087 | 84,375 | 13.5% |

| 32 | Greensboro, NC | 199,029 | 26,924 | 13.5% |

| 34 | Knoxville, TN | 260,373 | 34,679 | 13.3% |

| 35 | Bakersfield, CA | 168,321 | 21,420 | 12.7% |

| 35 | Charleston, SC | 224,818 | 28,572 | 12.7% |

| 35 | Indianapolis, IN | 552,222 | 70,148 | 12.7% |

| 38 | Fresno, CA | 207,701 | 26,128 | 12.6% |

| 39 | Louisville, KY | 377,669 | 47,099 | 12.5% |

| 40 | Syracuse, NY | 182,897 | 22,616 | 12.4% |

| 41 | Phoenix, AZ | 1,230,071 | 148,862 | 12.1% |

| 42 | Las Vegas, NV | 483,415 | 57,014 | 11.8% |

| 43 | Omaha, NE | 254,941 | 29,314 | 11.5% |

| 43 | Cleveland, OH | 613,085 | 70,451 | 11.5% |

| 45 | St. Louis, MO | 809,401 | 92,626 | 11.4% |

| 46 | Buffalo, NY | 332,389 | 37,642 | 11.3% |

| 46 | Virginia Beach, VA | 442,292 | 49,816 | 11.3% |

| 48 | Charlotte, NC | 690,953 | 77,498 | 11.2% |

| 48 | Kansas City, MO | 578,663 | 64,888 | 11.2% |

| 48 | Raleigh, NC | 371,995 | 41,695 | 11.2% |

| 48 | Dallas, TX | 1,696,056 | 190,035 | 11.2% |

| 52 | Harrisburg, PA | 165,626 | 18,450 | 11.1% |

| 52 | Pittsburgh, PA | 746,600 | 82,502 | 11.1% |

| 54 | Stockton, CA | 148,522 | 16,360 | 11.0% |

| 54 | Dayton, OH | 221,750 | 24,330 | 11.0% |

| 54 | Nashville, TN | 528,545 | 57,945 | 11.0% |

| 54 | Providence, RI | 420,887 | 46,090 | 11.0% |

| 58 | Madison, WI | 179,737 | 19,597 | 10.9% |

| 58 | Boise, ID | 214,359 | 23,316 | 10.9% |

| 58 | Akron, OH | 199,715 | 21,716 | 10.9% |

| 61 | Riverside, CA | 935,953 | 101,461 | 10.8% |

| 61 | Philadelphia, PA | 1,638,472 | 177,144 | 10.8% |

| 61 | New Haven, CT | 137,908 | 14,897 | 10.8% |

| 61 | Milwaukee, WI | 392,835 | 42,343 | 10.8% |

| 65 | New York, NY | 3,789,974 | 402,743 | 10.6% |

| 65 | Durham, NC | 150,713 | 15,916 | 10.6% |

| 67 | Rochester, NY | 297,579 | 31,128 | 10.5% |

| 67 | Minneapolis, MN | 1,034,946 | 108,214 | 10.5% |

| 69 | Scranton, PA | 156,471 | 16,303 | 10.4% |

| 69 | Baltimore, MD | 740,925 | 77,112 | 10.4% |

| 71 | Spokane, WA | 152,961 | 15,797 | 10.3% |

| 71 | Columbus, OH | 524,079 | 53,729 | 10.3% |

| 73 | Hartford, CT | 309,811 | 31,743 | 10.2% |

| 73 | Cincinnati, OH | 612,007 | 62,276 | 10.2% |

| 73 | Austin, TX | 558,660 | 56,709 | 10.2% |

| 76 | Sacramento, CA | 547,473 | 54,985 | 10.0% |

| 76 | Colorado Springs, CO | 197,227 | 19,682 | 10.0% |

| 76 | Salt Lake City, UT | 298,149 | 29,669 | 10.0% |

| 79 | Chicago, IL | 2,360,889 | 234,353 | 9.9% |

| 79 | Honolulu, HI | 200,686 | 19,890 | 9.9% |

| 81 | Bridgeport, CT | 231,122 | 22,741 | 9.8% |

| 82 | San Jose, CA | 375,523 | 36,577 | 9.7% |

| 82 | Des Moines, IA | 201,187 | 19,551 | 9.7% |

| 84 | Atlanta, GA | 1,500,707 | 143,592 | 9.6% |

| 85 | Los Angeles, CA | 2,168,812 | 206,957 | 9.5% |

| 85 | Boston, MA | 1,189,120 | 113,362 | 9.5% |

| 85 | Provo, UT | 136,310 | 12,980 | 9.5% |

| 85 | Seattle, WA | 958,295 | 91,185 | 9.5% |

| 89 | Albany, NY | 241,774 | 22,829 | 9.4% |

| 90 | Worcester, MA | 218,849 | 20,448 | 9.3% |

| 91 | San Francisco, CA | 961,002 | 88,882 | 9.2% |

| 91 | Richmond, VA | 351,543 | 32,487 | 9.2% |

| 93 | Kiryas Joel, NY | 173,243 | 15,807 | 9.1% |

| 93 | San Diego, CA | 632,194 | 57,414 | 9.1% |

| 95 | Denver, CO | 772,021 | 69,817 | 9.0% |

| 96 | Ogden, UT | 160,863 | 14,254 | 8.9% |

| 97 | Oxnard, CA | 178,388 | 15,559 | 8.7% |

| 97 | Allentown, PA | 234,260 | 20,423 | 8.7% |

| 99 | Washington, DC | 1,493,423 | 129,012 | 8.6% |

| 100 | Portland, OR | 620,392 | 47,827 | 7.7% |

Florida’s at-risk counties have highest rate of uninsured homes

While many homeowners may assume they don’t need home insurance because their properties aren’t at risk, a significant percentage of owner-occupied homes with high natural disaster risk aren’t covered. Looking at the 25 counties with the highest National Risk Index (NRI) scores, Miami-Dade County, Fla., has the highest uninsured rate at 23.5%.

Two other Florida counties followed: Broward County (22.7%) and Lee County (17.9%).

This comes despite significant hurricane risk. According to a LendingTree study on flood and hurricane events by state, Florida saw 307 hurricanes from 2021 to 2023 — nearly triple the next highest state.

% of uninsured homes (among at-risk counties)

| Rank | County | Homes | Homes w/out insurance | % of homes w/out insurance |

|---|---|---|---|---|

| 1 | Miami-Dade County, FL | 503,562 | 118,313 | 23.5% |

| 2 | Broward County, FL | 474,052 | 107,521 | 22.7% |

| 3 | Lee County, FL | 236,433 | 42,303 | 17.9% |

| 4 | Hillsborough County, FL | 348,066 | 55,912 | 16.1% |

| 5 | Palm Beach County, FL | 417,121 | 66,854 | 16.0% |

| 5 | Harris County, TX | 946,389 | 151,360 | 16.0% |

| 7 | Brevard County, FL | 193,755 | 30,751 | 15.9% |

| 8 | Shelby County, TN | 196,804 | 26,997 | 13.7% |

| 9 | Galveston County, TX | 93,591 | 11,225 | 12.0% |

| 10 | Clark County, NV | 483,415 | 57,014 | 11.8% |

| 11 | San Bernardino County, CA | 411,081 | 46,455 | 11.3% |

| 12 | Riverside County, CA | 524,872 | 55,006 | 10.5% |

| 13 | Cook County, IL | 1,198,834 | 124,280 | 10.4% |

| 14 | Santa Barbara County, CA | 78,754 | 8,061 | 10.2% |

| 15 | Orange County, CA | 606,605 | 60,148 | 9.9% |

| 15 | Charleston County, SC | 111,425 | 11,065 | 9.9% |

| 17 | Santa Clara County, CA | 361,910 | 35,610 | 9.8% |

| 18 | Los Angeles County, CA | 1,562,207 | 146,809 | 9.4% |

| 19 | San Mateo County, CA | 156,244 | 14,435 | 9.2% |

| 19 | Alameda County, CA | 320,712 | 29,412 | 9.2% |

| 21 | San Diego County, CA | 632,194 | 57,414 | 9.1% |

| 22 | Contra Costa County, CA | 278,509 | 25,149 | 9.0% |

| 22 | King County, WA | 520,391 | 46,575 | 9.0% |

| 24 | Ventura County, CA | 178,388 | 15,559 | 8.7% |

| 25 | Collin County, TX | 256,431 | 17,178 | 6.7% |

“A major disaster like a hurricane or tropical storm could leave a lot of people without enough resources to rebuild their homes,” Bhatt says. “This could have tremendous consequences — not only for the affected individuals but the entire community.”

In total, 14 of the 25 at-risk counties have 10.0% or more of homes lacking insurance.

Considering home insurance: Top expert tips

Disaster can strike at any time, and it pays to be prepared. For those uninsured but considering coverage, here’s some advice:

- Think about how you’d pay to rebuild your home after a disaster. “Having insurance protects you from having to take out a loan to rebuild or having to sell your property at a reduced price due to your home’s structural damage,” Bhatt says. “Insurance protects your equity.”

- Consider getting an insurance policy with high deductibles. This can protect you from potentially catastrophic losses while keeping your rates reasonably affordable.

- Talk to a few insurance agents to learn about your options. Different agents usually have access to different insurance products.

Methodology

LendingTree researchers analyzed the U.S. Census Bureau 2023 American Community Survey (ACS) with five-year estimates to gather home insurance cost data.

Owner-occupied homes with annual home insurance costs of less than $100 were classified as uninsured. The number of owner-occupied homes that paid less than $100 in annual home insurance costs in 2023 was divided by the total number of owner-occupied homes to calculate the percentage of uninsured homes. This was done nationally and by state and metro.

The U.S. Census Bureau 2023 ACS with five-year estimates was used to find the 100 largest metros and counties by population to be included in the analysis.

Additionally, Federal Emergency Management Agency (FEMA) National Risk Index (NRI) data was used to find the nation’s 25 most at-risk counties. This was used with the U.S. Census Bureau 2023 ACS with five-year estimates to rank the most at-risk counties by their percentage of uninsured homes.